Introduction to Investing Styles

Investing is a fundamental aspect of personal finance and wealth management, encompassing a variety of strategies that cater to different risk appetites and financial goals. Among these strategies, two predominant investing styles stand out: value investing and growth investing. Understanding the key tenets of each approach is essential for investors aiming to navigate the complexities of the financial markets effectively.

Value investing is characterized by the selection of stocks that appear undervalued relative to their intrinsic value. Investors employing this strategy meticulously analyze financial statements, looking for companies that trade below their true worth, thereby presenting a potential opportunity for growth. The philosophy is rooted in the belief that the market often misprices securities in the short term, leading to opportunities for savvy investors. The proponents of value investing emphasize principles such as discipline, patience, and a thorough fundamental analysis of a company’s financial health.

On the other hand, growth investing focuses on companies expected to grow at an above-average rate compared to their industry peers. Investors in this category look for stocks that exhibit strong revenue and earnings growth, even if such stocks come with a higher price-to-earnings ratio. Growth investing is predicated on the notion that high-growth companies can generate substantial returns over time, even if their current valuations appear high. This approach often entails a keen interest in market trends, innovation, and the potential for sustainable competitive advantages.

Both value and growth investing are essential frameworks within the investing landscape, each offering unique benefits and appeal to different types of investors. Recognizing the fundamental differences of these styles can enable individuals to make informed decisions that align with their financial objectives and investment strategies.

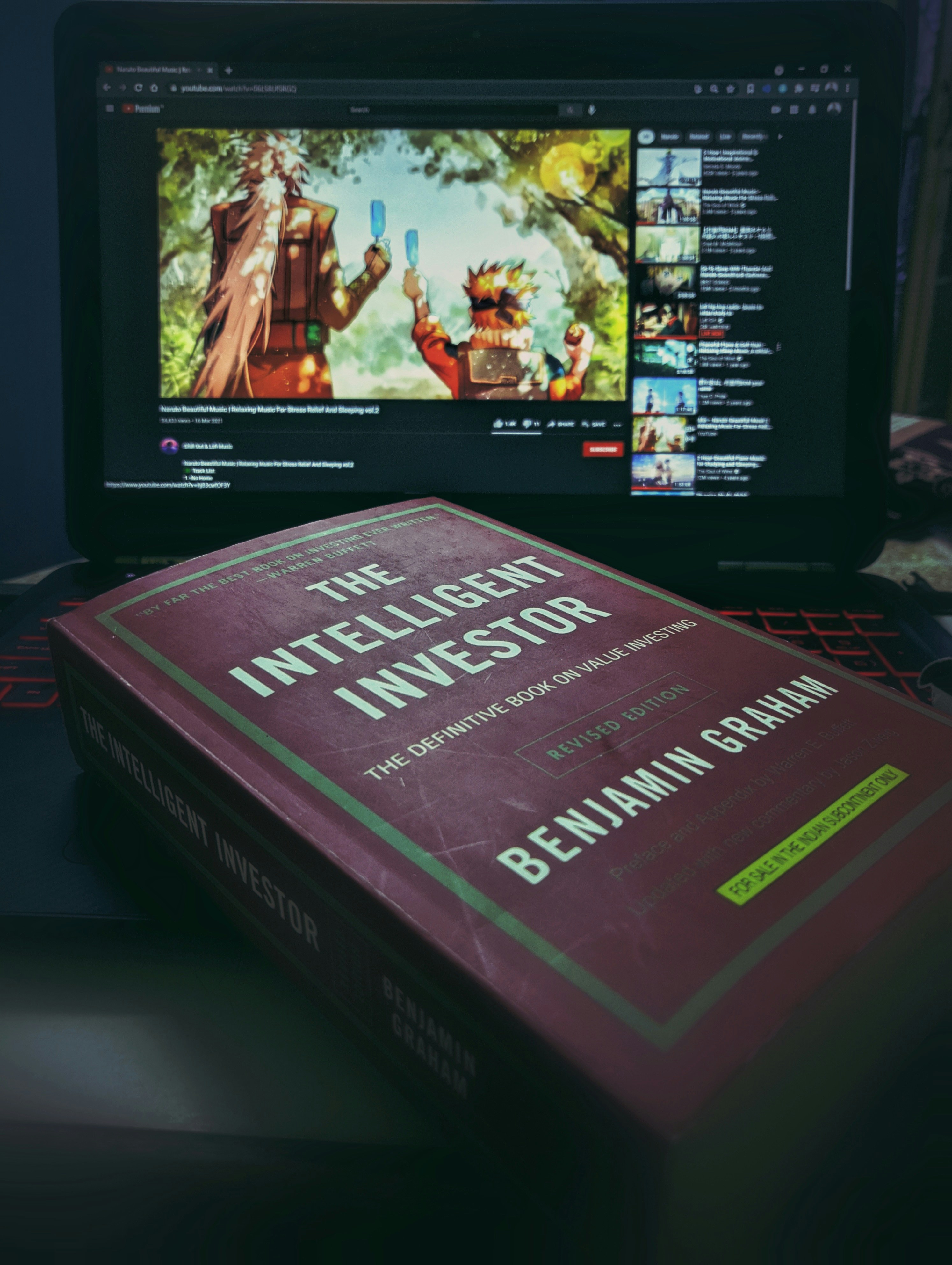

Understanding Value Investing

Value investing is an investment strategy that has roots tracing back to the early 20th century, prominently popularized by influential investors such as Benjamin Graham and David Dodd. The philosophy underpinning value investing revolves around the idea of purchasing securities that appear underpriced relative to their intrinsic value. This intrinsic value can be determined through various financial metrics, providing a fundamental analysis framework for investors.

Core principles of value investing involve a rigorous assessment of a company’s financial health, market position, and overall economic environment. Investors typically look for key indicators such as a low price-to-earnings (P/E) ratio, high dividend yield, or a discount to the book value. These factors help to identify potential value stocks that may have been overlooked or mispriced by the market. By focusing on these undervalued companies, investors aim to benefit from the eventual market correction that can occur when the true value of these stocks is recognized.

The process of identifying undervalued companies entails thorough research and analysis. Investors may utilize quantitative analysis, which includes evaluating financial statements, balance sheets, and cash flow statements, alongside qualitative assessments, such as examining the company’s management team and business model. A disciplined approach is essential in ensuring that investors do not conflate short-term fluctuations with the long-term performance of a robust company.

One of the long-term benefits associated with value investing is its potential to deliver superior returns compared to other strategies, especially during market downturns. Value stocks often exhibit more resilience in volatile markets, and patiently waiting for their value to be realized can yield significant rewards for disciplined investors. In conclusion, the principles of value investing serve as a cornerstone for creating a sustainable investment portfolio focused on capital growth over time.

Understanding Growth Investing

Growth investing is a strategy focused on identifying and investing in companies with the potential for substantial growth in revenues and earnings. Unlike value investing, which seeks undervalued stocks, growth investors prioritize companies that exhibit strong potential for future performance, often accompanied by significant reinvestment of profits back into the business to foster expansion. This approach has gained considerable appeal in recent years due to the lucrative opportunities it presents, particularly in sectors like technology, healthcare, and consumer goods.

One of the foundational characteristics of growth stocks is their consistently high growth rates, often measured in terms of earnings per share (EPS) or overall revenue growth. These companies frequently have unique products, innovative business models, or operate in emerging markets, making them attractive to investors seeking higher returns. Additionally, growth stocks may not always pay dividends, as the companies prefer to reinvest any profits to fuel further growth. This reinvestment strategy can lead to an exponential increase in stock prices, appealing to investors willing to accept a higher risk for potentially greater rewards.

Strategies utilized by growth investors often include rigorous analysis of a company’s earnings growth, market trends, and competitive positioning. Growth investors closely monitor various metrics such as price-to-earnings ratios (P/E), price-to-earnings growth (PEG) ratios, and revenue projections to discern promising investment opportunities. Despite the enticing prospects of high returns, growth investing is accompanied by higher risks, as it is subject to market volatility and the fluctuating performance of the underlying companies. Economic downturns or shifts in consumer preferences can significantly impact growth stocks, leading to potential losses for investors. However, for those who remain committed to long-term growth, this investment strategy can be highly rewarding.

Historical Performance: Value vs. Growth

When analyzing the historical performance of value investing and growth investing, it is essential to consider how each strategy has reacted during various market conditions. Traditionally, value investing focuses on companies trading below their intrinsic value, often characterized by robust fundamentals like low price-to-earnings ratios, while growth investing targets companies that exhibit above-average growth potential, even if they may appear overvalued by traditional metrics.

Data from the past few decades reveals some intriguing trends. For instance, the period from the early 1980s until the late 1990s largely favored value investing. During this phase, economic recovery in the U.S. led to significant gains in value stocks. Studies show that value stocks consistently outperformed growth stocks over these years, partly due to the high interest rates that favored stable, dividend-paying companies.

However, the late 1990s saw a dramatic shift with the rise of the technology sector and the dot-com bubble, where growth investing took center stage. Companies like Amazon and Google illustrated the potential of growth-oriented companies, delivering extraordinary returns for their investors. The subsequent decade, marked by market volatility and economic crises, saw a resurgence in value investing as investors gravitated towards stability and reliability amidst market uncertainty.

Recent studies have indicated that from 2000 to 2020, value stocks again demonstrated a notable disadvantage against their growth counterparts. This period was characterized by prolonged low interest rates, which benefitted growth companies, allowing them to thrive. Notably, value investing strategies have regained some traction in the early 2020s, correlating with economic recovery and inflationary pressures disturbing the complacency of growth stock valuations.

In conclusion, each investment strategy has had its share of triumphs and tribulations throughout historical market cycles. Understanding these dynamics can aid investors in making informed decisions about which style might align with their long-term goals and market outlook.

Risk and Return: A Comparative Analysis

When considering investment strategies, understanding the risk and return profiles of value and growth investing is paramount. Value investing, characterized by the purchase of undervalued stocks, generally tends to be less volatile than growth investing. Value investors seek stocks trading below their intrinsic value, often choosing companies with stable earnings and low price-to-earnings ratios. This approach can yield steady returns over time, particularly during bear markets, as value stocks are typically more resilient in downtrends.

On the other hand, growth investing focuses on companies expected to grow at an above-average rate compared to their industry or the overall market. These stocks often exhibit higher volatility due to their reliance on future performance and market expectations. Growth stocks may provide substantial returns during bull markets, but they can also suffer significant declines during economic downturns. This volatility often makes growth investing suitable for risk-tolerant investors who can withstand market fluctuations.

The performance of these two strategies can vary considerably depending on the prevailing market conditions. During periods of economic expansion, growth investing may outperform due to increased investor optimism and higher capital allocations to fast-growing companies. Conversely, during economic contractions or market corrections, value investing has historically outperformed as investors gravitate toward stable and established firms that are deemed safer bets.

The choice between these investment strategies often depends on an investor’s risk tolerance and objectives. For individuals with a long-term horizon and a higher risk appetite, growth investing may be more appealing, whereas those preferring steady returns and lower volatility may gravitate towards value investing. Understanding these nuances can aid investors in creating a balanced portfolio that aligns with their financial goals and risk tolerance.

Factors Influencing the Success of Each Strategy

Investing strategies, particularly value and growth investing, are significantly impacted by various external factors. Economic conditions, such as inflation rates and overall economic growth, play a crucial role in determining the performance of these strategies. For instance, during periods of economic expansion, growth investing typically flourishes as companies exhibit accelerated earnings growth, attracting higher price-to-earnings (P/E) ratios. Conversely, in economic downturns, value investing may prevail as investors seek safety in undervalued stocks that are expected to rebound when market conditions improve.

Interest rates are another critical factor influencing the success of value and growth investing. Lower interest rates may fuel growth investing by making borrowing cheaper for companies, thereby facilitating expansion and innovation. Consequently, investors may gravitate toward growth stocks during these periods. Conversely, rising interest rates can shift the favor toward value investing; higher rates often lead to increased discount rates applied to future cash flows, making growth stocks less attractive relative to their value counterparts.

Market sentiment also plays a pivotal role in the success of these investing strategies. Bull markets typically favor growth investing, as investor optimism drives higher valuations for companies positioned for future growth. However, in bear markets, where pessimism prevails, value investing often proves advantageous, as investors seek solace in fundamentally strong companies with solid financials and attractive valuations.

Furthermore, technological advancements can significantly influence the performance of both growth and value investments. Emerging technologies can disrupt traditional industries, propelling growth stocks to new heights while posing challenges to established value investments. Consequently, investors need to consider these external factors when determining which investing strategy may be more favorable in a given market environment.

Current Market Trends and Their Impact

As of October 2023, the dynamics of the market have transitioned, showing a distinctive inclination towards certain sectors that significantly impact investment strategies such as value investing and growth investing. Growth stocks have outperformed value stocks in recent months, propelled by advancements in technology and consumer-oriented sectors. The rise of artificial intelligence and digital transformation initiatives have fostered an environment where growth investments appear particularly attractive. Companies with solid foundations in innovative technologies have seen robust stock performance, leading investors to gravitate towards this sector.

Recent economic indicators, including inflation rates and interest rate adjustments, also play a crucial role in shaping investor sentiment. With central banks maintaining accommodative policies to support economic recovery, borrowing costs remain low, enhancing the appeal of growth investments. These factors create a landscape where capital can be reinvested at an accelerated pace, further driving stock prices. Conversely, value investing—characterized by a focus on undervalued companies with solid fundamentals—has faced challenges in gaining traction, particularly amid rising interest rates and uneven economic growth. Investors appear cautious, seeking out quality over speculative growth opportunities.

Moreover, sector performance has varied distinctly, with cyclical and consumer discretionary sectors seeing resurgence, while sectors traditionally associated with value investing, such as utilities and consumer staples, have struggled. This trend underscores the importance of adaptability in investment strategies, as market conditions are continually evolving. As investors analyze these trends, the decision-making process leans heavily on current data and market sentiment, driving them to evaluate the long-term viability of their chosen investment paradigm. Ultimately, understanding these market shifts is essential for making informed choices in the realms of value and growth investing.

Expert Opinions: Insights from Successful Investors

When considering the merits of value investing versus growth investing, the opinions of accomplished investors are invaluable. One prominent figure in value investing, Warren Buffett, often emphasizes the importance of intrinsic value. He states, “Price is what you pay; value is what you get.” This perspective underscores the principle that successful value investing focuses on buying undervalued companies that possess solid fundamentals. Buffett’s strategy aligns with a long-term vision, suggesting that patience in such investments often yields significant returns over time.

In contrast, Peter Lynch, known for his success in growth investing, advocates for identifying companies with strong potential for earnings growth. He famously remarked, “Know what you own, and know why you own it.” Lynch’s approach highlights the necessity of thorough research in selecting stocks that not only have promising growth trajectories but also appeal to market trends. His insights reveal that growth investors should be attuned to various market sectors and evolving consumer preferences, emphasizing flexibility when adapting to change.

Furthermore, Ray Dalio, founder of Bridgewater Associates, adopts a balanced approach that integrates both investment styles. He stresses that understanding the macroeconomic landscape can enhance investment decisions, allowing for better identification of value and growth opportunities. Dalio’s philosophy suggests that neither strategy is inherently superior, as the optimal approach may involve a combination that capitalizes on distinct economic phases.

Lastly, Cathie Wood of ARK Invest is a vocal proponent of innovation-driven growth investing. She believes that the future relies on disruptive technologies and transformative companies. Wood argues that investing in such growth areas can yield unparalleled long-term returns, as they often challenge traditional norms and lead to substantial market shifts.

In essence, insights from these seasoned investors highlight the diversity in investment philosophies and the factors influencing success in either value or growth investing. Their experiences illustrate that both strategies, when executed with discipline and informed analysis, offer pathways to achieving financial success in the long run.

Conclusion: Finding the Right Investment Blend

In the world of investing, both value investing and growth investing offer unique advantages, and determining which strategy is more effective ultimately depends on individual circumstances and goals. Value investing is characterized by the identification of undervalued stocks that have the potential for long-term appreciation. This approach appeals to those seeking stability and margin of safety, particularly during market volatility. On the other hand, growth investing focuses on companies poised for substantial growth, often trading at higher valuations due to their potential for future earnings. This method may attract investors who are willing to accept higher risk in exchange for substantial capital gains.

As we analyze the merits of these two distinct strategies, it becomes evident that a one-size-fits-all approach may not be suitable for every investor. Depending on one’s financial objectives, risk tolerance, and investment horizon, the most successful outcome may arise from adopting a blended strategy that incorporates elements from both value and growth investing. This balanced investment approach allows investors to capture opportunities from different sectors of the market while mitigating overall risk.

Moreover, market conditions continuously evolve, and what works best at one point in time may not yield the same success in the future. Economic cycles, technological advancements, and shifts in consumer preferences can dramatically influence the performance of both value and growth stocks. Therefore, an adaptive investment strategy, which is responsive to changing market dynamics, can provide an edge in optimizing returns.

In conclusion, aspiring investors should evaluate their unique financial goals and consider a diversified investment strategy that blends both value and growth investing principles. By doing so, they may position themselves more effectively for long-term success in an ever-changing market landscape.